For over a decade the poster boy of Indian IT sector, Infosys, led a charmed existence. The Bangalore based IT firm known as the IT bellwether had built a reputation to under promise and over deliver on the results front. It now appears that Infosys has hit a road block.

Infosys has been struggling since quite some time and things seems to have got worse when the 4th quarter results for FY11-12 were announced. Infosys had delivered a shocker. The company missed its revenue forecast for the quarter and the year. It said it would grow revenues between 8 and 10 per cent in FY12-13, significantly lower than the 11-14 % growth that Nasscom had predicted. The market hasn’t taken this news kindly and punished the stock relentlessly.

So what has gone wrong with the Infosys story?

Analysts say that Infosys has failed to keep pace with the changes happening outside. It’s one thing to reach the top and another thing to stay there. Infosys is clearly struggling to stay there.

The thing that has worked in favor of Infosys now seems to derail its growth story. Strangely enough the reasons for its success in the last decade seem to be the reason for its current problem.

Throughout the 1990s Infosys had perfected the global delivery model (GDM). It concentrated only on the US and Europe. It focused on becoming a leader in just a couple of sectors — BFSI (banking and financial services) and manufacturing, and it delivered excellence in a few areas of IT services — package implementation, application development and maintenance (ADM in industry parlance) and testing.

Infosys was a pioneer in many of these fields. Also because of its excellence in process and in house systems it was able to charge a premium over other Indian IT companies. Even after charging a premium its cost were much less compared to the global IT service providers like IBM and Accenture. One of the main reasons for this was the human arbitrage factor that Indian companies enjoyed.

This premium pricing led to Infosys maintaining a higher EBITDA margin than its peers. Infosys has over the years maintained this high margin of over 30 percent. It would not go in for deals with lower margins and was very rigid with its pricing.

This model worked for them very well till around 2009. Post 2009 things in its main market, US, changed. Clients were now looking at getting the maximum out of their IT deals and were looking at reducing costs.

Rise of the mid-cap players

Post 2009 some of the then smaller companies like Cognizant and HCL have caught up with the Big3- TCS, Infosys and Wipro. In fact Cognizant has replaced Wipro as the third biggest player and very soon will also replace Infosys.

As you can see from the above figures, Infosys has always been a big margin player operating in the 30 percent or above region. Companies like HCL and cognizant have been able to eat into Infosys market share because of the premium strategy followed by Infosys. These companies are gaining at the cost of Infosys.

Critics feel that Infosys is overly focused on service delivery and not enough on the top line numbers; that it only focuses on maintaining margins at the expense of getting new deals. Smaller rivals Cognizant and HCL are winning market share partly due to Infosys’ reluctance to reduce prices in a difficult market.

“ADM is quickly becoming commoditized. Everyone of a certain scale can deliver services of nearly the same quality and cost," says Vineet Nayar, CEO, and HCL Tech. As a result of this Infosys is losing its premium position.

The 850 billion IT industry is looking at a smaller growth rate in future. In such a scenario, when clients are cutting down on the fresh contracts, the big opportunity lies in the churn of existing contracts which will need a slightly different business strategy.

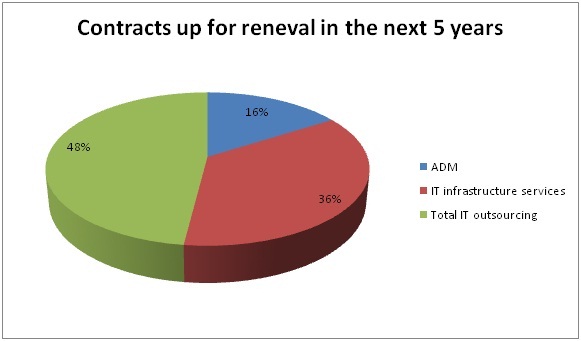

As per outsourcing advisory IDG’s numbers, of the $207 billion worth contracts up for renewal in the next five years, only 16% are in ADM; 36% is in IT infrastructure services and 48% is in total IT outsourcing.

It seems that companies like HCL and cognizant are chasing this market and Infosys has been left behind.

Is it all about the business model?

Infosys’s focus on the ADM model has become outdated. If all companies recruit from a similar set of colleges, work with similar clients and are capable of delivering the same output then there is no scope to charge a premium. The entire ADM business has become commoditized now.

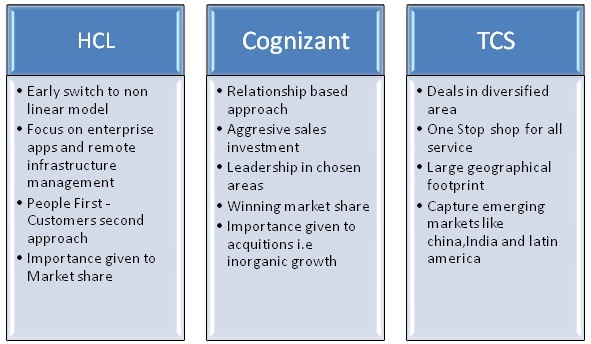

"This is a battle of business models, not of individual companies," says HCL CEO Nayar. "We are the No. 1 player in three of the four markets we are in and application development is a must to undertake total IT deals."

In turn, Cognizant has focused on four industries and tried to assimilate service delivery lessons from India based vendors as also build consulting muscle like IBM. R. Chandrasekaran, President and Managing Director of Cognizant says, "Our strategy focuses on winning as many customers and broad-basing our range of service offerings across mature and emerging verticals."

Strategies used by some of the Indian IT players

Mergers and Acquisitions

Also over the years Infosys has followed a very conservative approach. It has a cash pile of close to 4 billion which is almost 50 percent more than TCS. Yet the company has been very slow in acquisitions. It has preferred the organic growth method.

At the same time its peers have acquired companies and have gone ahead with Inorganic growth.

1: TCS’s acquisition of Financial Network Services (FNS), an Australian core banking Solutions Company, led to the evolution of the ‘TCS BaNCS’ product which is used extensively in the industry.

2: HCL acquired Axon in December 2008 for about USD 660 million. The acquisition was directed at blending the SAP practice of target with existing capabilities of acquirer and come up with productized solutions for large transformational engagements. The acquisition was able to help the company expand its revenues from this stream to reach USD 718.0 million in 2011 accounting for 21.3 percent of company’s revenues.

The other side of the story

Infosys has been in the industry for over 30 years and has arguably been one of the reasons for the tremendous growth of the sector in the last decade. With so many years of experience in the industry, Infosys would be aware of its current problems related to its margin strategy. So what is Infosys’s view regarding their margin strategy and why does it persist with this strategy.

Infosys CFO, V Balakrishnan believes that Infosys is the pricing umbrella for the entire industry. According to him, if Infosys reduces its price then the entire industry will suffer. Shibulal who is the current CEO also shares similar views. He feels that the easiest thing to do would be to reduce the price now and reap the benefits. This might work in the near future but as the compensations are increasing and clients keep on demanding more value for their money it would be difficult to maintain these low prices in the long run. Also the reduced pricing will create a price war amongst the top players which cannot be good for the industry.Shibulal believes that Infosys has taken the right route which is not necessarily the easy route.

The way forward: Non Linear Growth

Infosys’s goal is to migrate to higher value offerings to maintain its ability to charge premium pricing. The company is planning to achieve this by gradually shifting to products and platform based solutions. The role of intellectual property is very important here. Also all these solutions would be sold through a consulting led-approach which will help the company to move on to a higher value chain.

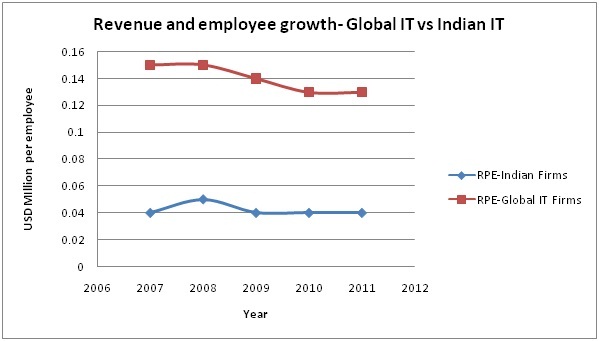

It looks like Infosys is trying to move from a linear growth model to a non linear model. Over the years the revenues of IT companies increased proportionally to the number of employees working in the company. This is called a linear growth model. Given the challenging IT environment, the linear growth model is neither sustainable nor desirable and companies are shifting to a non-linear model.

In fact, companies like HCL Tech, shifted to this new model quite early. Infosys is beginning to catch up now. The revenue per employee figures of global companies is currently much higher compared to their Indian counterparts.

Source: Non Linear Model, KPMG

From a very long term perspective, Infosys might try to match these levels but as of now it looks difficult. For now, Infosys’s management is confident that they are on a right track and 2-3 disappointing quarters would not change their long term strategy. And as they say, the success of your business strategy can only be judged in hindsight. Let us wait and watch as only time will tell whether Infosys can reestablish itself as the bellwether of the IT industry.